Strategies and Techniques for Change Agents, Strategists, and Innovators

A reader suggested that I weigh in on the current shakeup going on at Amazon. I grimaced at the suggestion.

Since I left Amazon in late 2005, my entire mission has been to advise management on innovation and growth by leveraging “the Amazon Way.”

This reader request results in an uncomfortable newsletter. But it’s past time to admit that Amazon is not the same place it was when I was there, and someplace along the way of becoming the everything store, they forgot their playbook.

Since first releasing The Amazon Way in 2014, I've been asked many times — “what do I think Amazon’s biggest challenges and risks are?”

My answer has been consistent — “Themselves and Success.”

I believe Jeff Bezos's greatest fear for Amazon was that it becomes a bureaucracy. A place where people become more concerned about optics than building great services and delivering great experiences for customers. A place where it becomes too hard for good teams and leaders to get the right things done. A place that slows down and becomes bloated.

I never envisioned needing to write this newsletter. I learned so much at Amazon and admire the company and its high-expectations culture. But perhaps with the intoxication of “Think Big” and a soaring stock, they got carried away. They ran the “BIG BET” playbook too many times.

This week’s Digital Leader Newsletter is all about Amazon.

Headlines

I’m not breaking any news. Here’s what I know about the current situation regarding cutbacks and key changes at Amazon (with a link for each).

On 11/15 the New York Times reports that “Amazon plans to lay off approximately 10,000 people in corporate and technology jobs starting as soon as this week, people with knowledge of the matter said, in what would be the largest job cuts in the company’s history.” READ.

On 12/2, reports that it it might now be 20,000, including about 6% of corporate staff. READ

Alexa — a significant portion of the 10,000 are reported to be in the Alexa unit. Business Insider spoke with "a dozen current and former employees on the company's hardware team," who described "a division in crisis." READ

In India, shutting down Amazon Distribution, its wholesale distribution business; Amazon Food - the food delivery business; Amazon Academy — an online learning platform. READ

Amazon Care — Focused on Amazon employees but ramping up partnerships with other companies, Amazon Care was a telehealth-based service that is being shut down. READ

Scout — The cute four-wheeled in-home delivery robot is being “significantly scaled back.” About 400 people reportedly work on this project. READ

AMP — I didn’t even know this existed. Amp “allows users to broadcast their own live radio shows and has been courting content creators.” 150 people were let go in late October. READ

Amazon has frozen all corporate hiring after already freezing hiring in the retail business. READ

Activist investor Daniel Loeb of Third Point LLC has a stake of ~$770M. He notes “our conviction that Amazon is at an important crossroads as new management considers its long-term strategic plan to move the company forward, which may include several bold initiatives that are the subject of wide market speculation at the proverbial investor water cooler.” READ

Amazon has rescinded offers in the retail and private label business. According to The Information, “Representatives from the retail organization, which is led by Amazon’s CEO of Worldwide Amazon Stores Doug Herrington, this week began calling people who were due to start in January to tell them their jobs were being rescinded, according to two people who had offers rescinded.” Brutal and perhaps avoidable. But necessary. READ

Jeff Blackburn, one of the few remaining longtime S-Team members, announces his departure again. Blackburn was the leader of the global entertainment division, including Prime Video, Prime Studio, Amazon Music, Wondery, Audible, Twitch, and Amazon Games. I’m guessing this portends significant changes and reductions in these entertainment groups. READ

So my regrettable message to Amazon is this — All of this is a great start. Now let’s get serious.

Zero-Base Mindset on EVERYTHING

I spent twelve years as a Managing Director at a turnaround consulting firm after I left Amazon (Alvarez and Marsal from 2005 through 2017). The biggest mistake made in turnarounds is not going fast or deep enough, leaving ineffective results and a team that knows that more cuts are likely in the future. His plan needs to go fast and deep. Take a full dose of the bad medicine once.

Start with a zero-based “rationalize in” mindset. Throw everything out (figuratively) to start. Then rationalize why the business, capital, or program should be refunded at all and at what level, and then add it back into the business.

Zero-based budgeting (ZBB) is a budgeting method where all expenses must be justified and approved in each new budget period. Developed by Peter Pyhrr in the 1970s, the organization's needs and costs are analyzed by starting from a "zero base" (i.e., no funding allocation) at the beginning of every period.1

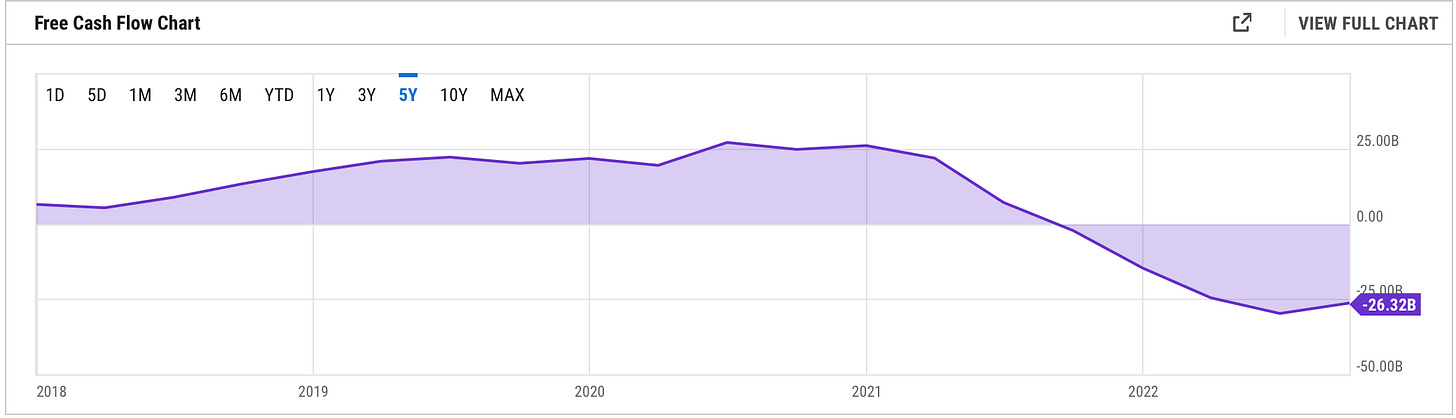

Show the world the free cash flow generation machine that Amazon is without a bloated cost structure. This would be a flex showing that Amazon’s core businesses are a profit-generating machine.

Free Cash Flow Past 5 Years

Brutal Rationalization of Capital Expenses

Grok (deeply appreciate) these relative data points on capital expenditure…

Amazon.com's latest twelve months’ capital expenditures are $65.988 billion.

Apple - $11.085B

Meta - $39B (2022 projected. Also cutting 13% of the workforce)2

Microsoft -$24.3B

Alphabet - $30.2B

Amazon Capital Annual Capital Expenditures

In the 2021 Q4 analyst briefing, the Amazon CFO stated:

Just under 40% of that CapEx is going into infrastructure, most of its feeding AWS, but also certainly, Amazon is a large customer of that as well as we build and structure for ourselves directly or through AWS.

About just under 30% is fulfillment capacity building warehouses -- warehouse only, not transportation. And then just under 25% is transportation capacity and building out our AMZL network, principally globally. The remaining 5% or so is small things like offices and stores and other capital areas. But those are the three main areas.3

Amazon has already been retracting the fulfillment center capital. Now focus on the other big category — AWS. Use the frugality constraint to “get more done with less” and drive higher utilization, efficiency, and lifespan of existing AWS infrastructure. Obviously, AWS is a proven business, and the goal of a turnaround plan is to invest in proven businesses. I’m just suggesting that there are likely “constraint-driven” utilization and lifespan improvements to find.

But the turnaround plan is not done yet…

Spin-off or Mothball the high-risk BIG BETs

Amazon has a portfolio of unprofitable, capital intensive, high risk BIG BETS. These programs all have remaining substantial technical, feasibility, regulatory, and business ROI risk. Perhaps an extremely leaned-out team could continue leaving the option to increase the investment in the future. Or perhaps they should be completely spun off or shutdown.

Here are the BIG BET Initiatives I know of to be scrutinized. Are there others?:

[Read last week’s article on BIG BET INITIATIVES]

Alexa and Devices: I don’t know anyone who uses an Alexa for anything other than turning on a timer, music, or lights. For some reason, Amazon kept doubling down at the roulette wheel with this BIG BET hoping that “this time, it will be different.”

“If you look at Google Assistant or Siri, they suffer from the same thing. I think it’s a fundamental technology thing. Maybe we deluded ourselves back in 2015-2016 that we were going to solve those last problems really quickly. They haven’t been solved. It’s still not a great experience for a lot of customers.” — Tigger Kindel, former Alexa product management leader in Geekwire interview HERE

Customers have spoken. Put Alexa on a radically lower spending basis (90% lower?).

Alexa leadership likely needs to be replaced not because they aren’t brilliant or good leaders but because they are “in love” with the vision, product roadmap, and hard work already done to approach with a zero-based mothball mindset.

Project Kuiper: According to Amazon, “Project Kuiper is an initiative to launch a constellation of Low Earth Orbit satellites to provide low-latency, high-speed broadband connectivity to unserved and underserved communities around the world.” The Amazon jobs page lists 116 open positions.4

A $10B dollar commitment for a pre-revenue business in a category Amazon has not operated in before. Things that make you go hmmmm. READ

Perhaps the potential of this business is better served in a company whose core business is in building and launching rockets and satellites. Any come to mind??? Spin it off or shut it down.

Drones: Although “on the cusp of launching” in Lockeford, CA (READ), should this ambition be tamped down and take a “follow the leader approach”? Let others blaze the trail of likely accidents, regulatory challenges, expenses, etc.— and then make a bold move. I’m a big skeptic.

Raja Sengupta, a transportation engineering professor at UC Berkeley who has worked with drones for nearly 30 years, said the technology in autonomous drones is advanced enough for Amazon Prime Air to work. But given Amazon’s history of problems in testing, Sengupta expressed skepticism about factors such as poor weather and moving obstacles such as a dog or cat.

“It’s one thing to do it in a university or in testing, and it’s another thing to do it as a product that is sustainable and repeatable,” Sengupta said.5

Zoox: Fully autonomous, electric vehicles. Acquired for a reported 1.2 billion. Here is Geekwire’s June 2022 article (READ). Sounds years (decades) away. The Information just released an article on the cash flow situation at seven electric car companies that have gone public.

Three of the seven electric vehicle startups that have gone public since 2020, mostly through mergers with SPACs, recently warned there is “substantial doubt” about their ability to survive another year without raising more capital. The others have at least a year or two of cash left.6

Zoox has chosen one of the most expensive possible paths in the autonomous driving industry, seeking to build a fit-for-purpose self-driving passenger vehicle from the ground up, along with the software and AI end to provide its autonomous driving capabilities.7

Again — spin it off or shut it down.

Lobbying: While not a “big bet,” it just seems too big. Amazon reportedly has between 100 and 200 lobbyists and spent $169M in 20218. When I was at Amazon, we had one (1) lobbyist. For reference: Microsoft spent $10M and has ~120 lobbyists.9

By 2020, Amazon had registered at least 180 lobbyists in 44 U.S. states, up from at least 62 lobbyists in 27 states in 2014, the year before Carney arrived, according to a Reuters analysis of state records.10

Which “big bets” are not on the list? Several. The turnaround plan does not sacrifice proven growth and efficiency programs. Advertising and Prime Video are proven businesses without technical, feasibility, or regulatory risks. Healthcare initiatives have great alignment with several Amazon business capabilities. Amazon just needs to manage the rate of investment in these areas.

Break Up The Beatles

Yes, it’s been an amazing journey together. AWS, retail, logistics, devices, content — the entire flywheel. But it’s time to break up the greatest band ever. Spinning off AWS would create shareholder value AND unleash the next epoch of growth, innovation, and competition. It’s time to “think like an owner.”

Recent analysis estimates that AWS, as a standalone entity:

AWS, as Amazon Web Services is known, has a so-called enterprise value of more than $1.5 trillion, almost as much as the company’s current market value of $1.6 trillion, according to a slide shared on the call, the people said. Meanwhile, Amazon’s retail business could be worth some $1 trillion.11

This is a smart and frankly obvious decision to make. I know Amazon’s long-stated position on this. But think about it.

Along with an AWS spinoff, perhaps separate the Amazon private label business as a nod to the inherent competitive conflict between the marketplace, retail and private label brands.

A Return to Frugality

Some people at Amazon might be surprised by this, but frugality is a leadership principle. This LP calls on us to “accomplish more with less” and innovate by using constraints.

Frugality

Accomplish more with less. Constraints breed resourcefulness, self-sufficiency, and invention. There are no extra points for growing headcount, budget size, or fixed expenses.

Cancel all travel. Cancel all corporate recruiting. Cancel any non-essential internal programs. This will get everyone’s attention and focus on delivering profitable growth.

These frugal moves might be more symbolic than impactful, but the “door desk” mentality needs to be re-established for the culture to reset.

This gets to the last topic. Incentives.

Establish an “all-in” alignment to hit the business unit P&L and growth targets. Make this high stakes — for exceeding, hitting, or not-hitting P&L and growth targets.

Protect the Brand

There are areas where more than investment and expense reduction is needed. These might even require an increase in investment. The strategy is simple — protect the brand by improving customer satisfaction and employee safety.

First — Improve customer satisfaction.

Last year, customer satisfaction at Amazon declined to a record low on the American Customer Satisfaction Index, which tracks shopper approval at more than 400 of the largest companies in the U.S.

Amazon scored 78 out of 100, down from 86 out of 100 five years earlier and its worst performance since 2000—the year the index started tracking the Seattle-based company. In 2020 and 2021, Amazon fell behind the shopping sites of Costco Wholesale Corp. and Nordstrom Inc.

Consulting firm Brooks Bell earlier this year also surveyed more than 1,000 Amazon customers in the U.S. and found that nearly a third of them reported regularly receiving products late or getting an item of low quality. That is the first time the firm conducted the study.12

Do this by cleaning up the marketplace, improving the seller experience, and improving on-time two-day Prime delivery. The payback is guaranteed both short-term and long-term. Here’s an article on recent Prime Day issues demonstrating the need to serve sellers (and customers) far better. READ

Second — Fulfillment center employee safety. Continue to make this a top priority and set lofty goals. As the Amazon leadership principle states, “Leaders work every day to create a safer, more productive, higher performing, more diverse, and more just work environment.” This is not only the right thing to do, but it will create brand loyalty and will force innovations that scale.

A Culture Turnaround

In writing this article, I connected with a few other ex-Amazon observers. Here is one keen insight:

During my tenure there, we never experienced anything other than huge growth YOY. I don't really have a lot of experience with how well Amazon deals with macro slowdown in growth. Employees during my tenure were used to growth in Amazon as well as constant growth in price of the AMZN shares, which created this odd situation where people EXPECTED success. I wonder how many Amazon employees today expect success/growth, vs. how many Amazon employees are realizing that strong growth is really hard and requires a careful understanding of the 3-5 most important key drivers within each business that are impactful to growth.

I was at Amazon during a period when the stock was essentially flat. From 2002 to 2009, the stock went from ~$0.90 to $2.7. And most of this increase happened in 2008. The period we are in is going to test the grit of the employees.

With sixteen leadership principles, there will be cycles where different LPs are emphasized during others. This is the end of the “THINK BIG” era and starts the “Ownership” era. Focus on:

Ownership - “They think long-term and don’t sacrifice long-term value for short-term results.”

The “and Simplify” part of “Invent and Simplify.” - “always find ways to simplify.”

Frugality - “Constraints breed resourcefulness, self-sufficiency, and invention.”

Deliver Results - “Despite setbacks, they rise to the occasion and never settle.”

Why do I call this the start of the “ownership” era? I believe these dramatic changes are needed to protect and create the long-term value of Amazon. This is the painful turnaround playbook a true owner would take.

Summary

The Amazon I was at in 2002 - 2005 was a very different place — but I think, in many ways, mirrors where Amazon is at today. Our rules were “keep headcount flat” and “optimize for profitable growth.” Fiscal moderation and customer trust building are the playbooks needed now.

Perhaps this is why Bezos put Jassy in charge. He saw “Day 2” approaching and knew that a return to frugality, thinking like an owner, and constraints were necessary. I have full faith that Andy is the right CEO to avoid “day 2” by taking all the hard medicine now.

I continue to be an investor in Amazon and, more important, an advocate for the leadership and business foundations leading to this legendary company. I’m optimistic about Amazon’s future— but only if Day 2 is avoided today.

Onward.

John

About The Digital Leader Newsletter

This is a newsletter for change agents, strategists, and innovators. The Digital Leader Newsletter is a weekly coaching session focusing on customer-centricity, innovation, and strategy. We deliver practical theory, examples, tools, and techniques to help you build better strategies, better plans, and better solutions — but most of all, to think and communicate better.

John Rossman is a keynote speaker and advisor on leadership and innovation.

Learn more at https://johnrossman.com

https://en.wikipedia.org/wiki/Zero-based_budgeting

https://techcrunch.com/2022/11/09/filing-meta-slashes-expenses-on-reduced-hiring-and-capex-investments/

https://seekingalpha.com/article/4485372-amazon-cash-flow-q4-earnings-insight

https://www.amazon.jobs/en/teams/projectkuiper

https://www.theinformation.com/articles/electric-vehicle-startups-face-cash-crunch?utm_source=sg&utm_medium=email&utm_campaign=article_email&utm_content=article-9252

https://www.theinformation.com/articles/electric-vehicle-startups-face-cash-crunch

https://techcrunch.com/2020/06/26/amazon-to-acquire-autonomous-driving-startup-zoox/

https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2022&id=D000023883

https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2021&id=d000000115

https://www.reuters.com/investigates/special-report/amazon-privacy-lobbying/

https://www.marketwatch.com/story/daniel-loeb-sees-1-trillion-in-untapped-value-in-amazon-11645065436?link=MW_story_latest_news

https://www.wsj.com/articles/amazons-customer-satisfaction-slips-with-shoppers-11668986981

Good Stuff. I would also add Amazon India as a whole (not just piece meal cuts). And Prime Video.